Build Budgets That Actually Work for You

You've probably tried budgeting before. Maybe you downloaded an app, maybe you made a spreadsheet. Either way, it lasted about three weeks. This program teaches something different – budgeting that fits your life, not someone else's rigid system.

Talk About Your Goals

Who's Teaching This Anyway?

These aren't theoretical finance professors. Marlene and Felix have spent years helping real people in Vietnam figure out their money stuff. They've seen what works and what doesn't.

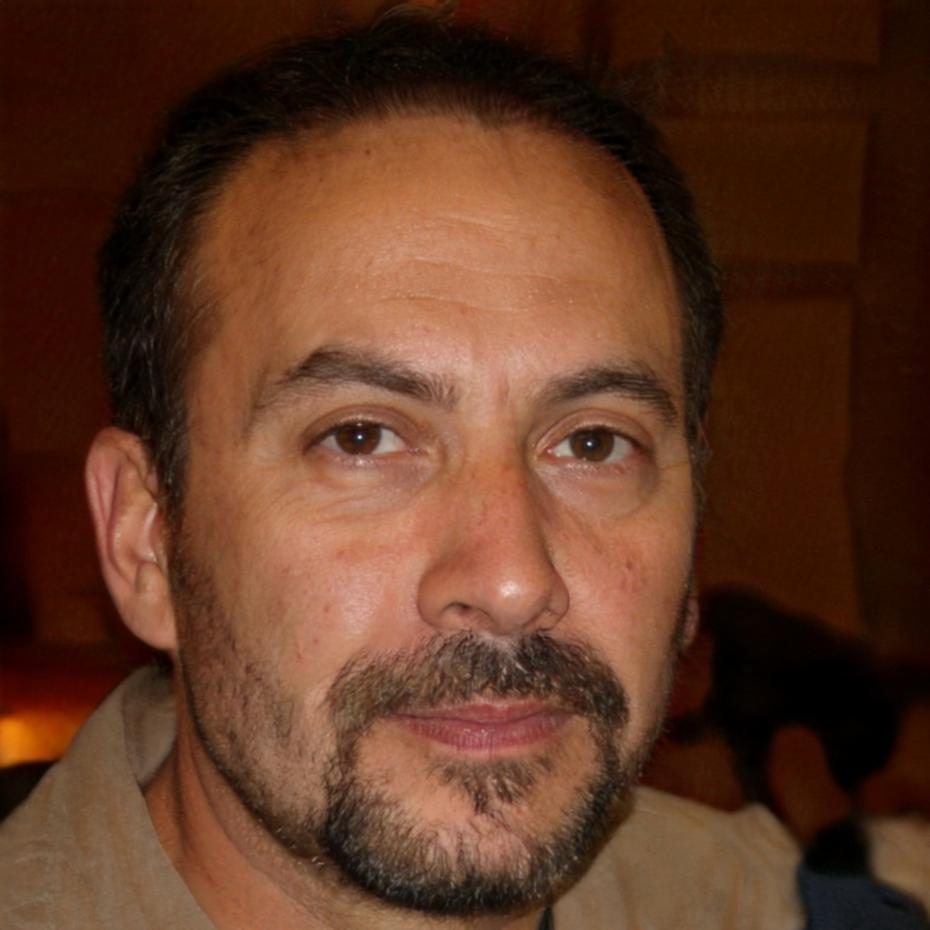

Marlene Hartley

Budget Strategy Lead

Marlene worked in retail for six years before switching to finance education. She gets that budgeting advice from someone who's never worried about money feels pretty useless. Her approach focuses on small wins that build up over time. She's taught over 200 people since 2021, mostly folks who thought they were "bad with money" but just needed better tools.

Felix Drummond

Personal Finance Coach

Felix spent his twenties making every financial mistake possible. Then he spent his thirties fixing them. Now he teaches other people how to skip the mistakes part. His teaching style is practical and doesn't involve lectures about compound interest. He's helped students in Gia Lai and beyond create budgets that last longer than New Year's resolutions.

How We Actually Teach This

Forget spreadsheet templates and generic advice. This program uses something we call reverse budgeting – you start with what you actually do with money, not what some book says you should do.

-

Start With Real Numbers

Week one is just tracking. No judgments, no changes. You need to see where your money actually goes before you can do anything useful with it. Most people are surprised.

-

Find Your Spending Personality

Some people need every expense categorized. Others go crazy with that level of detail. We help you figure out which type you are, then build a system that matches.

-

Build Flexibility In

Life happens. Car repairs, family emergencies, random expenses. Budgets that don't account for this fall apart fast. We show you how to plan for unpredictability.

-

Test and Adjust

Your first budget won't be perfect. That's fine. We spend weeks testing different approaches until something clicks. It's more experiment than exam.

What People Actually Get Out of This

These aren't guarantees. Every situation is different. But here's what we've seen happen when people stick with the process.

Two months of focused work. Each session builds on the last one.

Support continues after classes end. Real change takes time.

Of students from 2024 cohorts still budget regularly six months later.

How Eight Weeks Actually Breaks Down

-

Track Everything

Just observe. Write down every expense. The goal is awareness, not perfection.

-

Find Patterns

Look at your tracking data. Where does money disappear? What surprises you?

-

Set Real Goals

Not "save more money." That's vague. Something specific you want to afford or achieve.

-

Build Your System

Create a budget structure that matches how you think about money. Test it this week.

-

Handle the Problems

Your budget didn't work perfectly. Good. Now we fix what broke and try again.

-

Plan for Surprises

Build in buffer money. Figure out your backup plan. Make your budget less fragile.

-

Make It Automatic

Set up whatever systems help your budget run without constant attention.

-

Long-Term Habits

Review what worked. Set up your ongoing routine. Plan your monthly check-ins.